Second home mortgage how much can i borrow

Find out what you can borrow. However as a drawback expect it to come with a much higher interest rate.

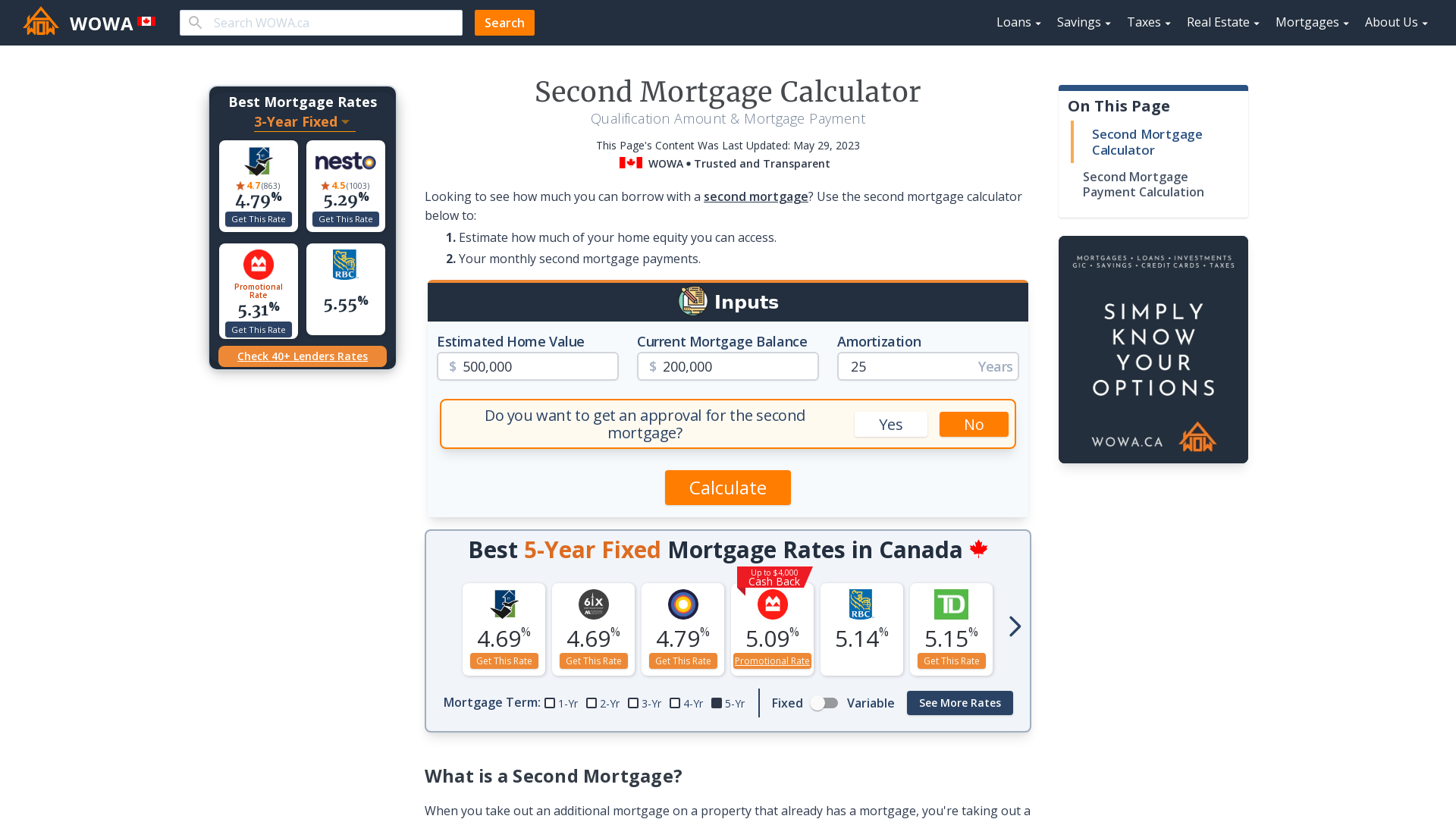

Second Mortgage Calculator Qualification Payment Wowa Ca

Some lenders allow you to take up to 90 of your homes equity in a second mortgage.

. Your home is an asset and that asset can gain value over time. According to the Society of Mortgage Professionals most second charge mortgages are valued between 10000 and 1000000. Using your existing equity.

The usual rule of thumb is that you can afford a mortgage two to 25 times your income. Enter your details in the calculator to estimate the maximum mortgage you can borrow. That can greatly impact your decision on whether to choose a 30-year fixed rate loan or a shorter term.

All lenders order an appraisal during the mortgage process in order to assess the homes market value and make sure the borrower is not attempting to borrow more money than the house is worth. A mortgage loan or simply mortgage ˈ m ɔːr ɡ ɪ dʒ in civil law jurisdicions known also as a hypothec loan is a loan used either by purchasers of real property to raise funds to buy real estate or by existing property owners to raise funds for any purpose while putting a lien on the property being mortgaged. The longer term will provide a more affordable monthly.

You can take a 100 percent mortgage if youre looking to secure a home loan without making a deposit. You are looking to change from your current rate to a new mortgage and borrow more on top of what you owe on your current mortgage. How much can I borrow if I already have a mortgage.

Calculate your monthly mortgage repayments to see what you could afford to borrow when moving house remortgaging or buying your first home. How much can you afford to borrow for a mortgage. A home-equity loan also known as an equity loan a home-equity installment loan or a second mortgage is a type of consumer debt.

A second mortgage is a type of loan that lets you borrow against the value of your home. This mortgage calculator will show how much you can afford. Pros Of A Second Mortgage.

You could cover all or part of the purchase using the. With a second mortgage loan you get to finance the home 100 percent but neither lender is financing more than 80 percent cutting the need for private mortgage insurance. Your income expenses and deposit are the biggest factors determining your borrowing power but lenders also consider other factors such as your existing debts and if you are using a guarantor for the loan.

You can only borrow against the equity you already have not against the full value of. Or 4 times your joint income if youre applying for a mortgage. First time buyers can take out a mortgage of up to 90 of the purchase price of a home.

Second mortgages can mean high loan amounts. Making the Choice There are many advantages to choosing a second mortgage loan rather than paying PMI but the ultimate choice depends on your personal financial. Second mortgages which can be home equity lines of credit HELOCs or home equity loans are a way to use that asset for other projects and goals without having to sell your home.

It allows home owners to borrow against. Mortgage providers will look at your income and outgoings to see if you can keep up with repayments if interest rates rise or your circumstances change. At 60000 thats a 120000 to 150000 mortgage.

The more common of the two is the 801010 mortgage arrangement in which the home buyer is granted an 80 percent loan-to-value LTV on the primary mortgage and 10 percent LTV on the second mortgage with a 10 percent down payment. Before applying for a mortgage you need to think about more than just whether you can afford the monthly repayments. A shorter loan term can help you save more money on interest charges during your repayment period but result.

How much can I borrow with a second charge mortgage. This means that you can borrow more money with a second mortgage than with other types of loans especially if youve been making payments on your loan for a long time. Our borrowing power calculator asks you to enter details including your loan term and interest rate income and expenses and any.

Of course this depends on both parties circumstances and the addition of an applicant with very little or no income. Mortgage House is one of Australias trusted and fastest growing major non-bank home loan lenders. Most mortgage lenders will let you borrow up to 45 times your salary but the size of the second mortgage you qualify for is also determined by the amount of equity you have along with your credit history.

How Much Mortgage Can I Afford if My Income Is 60000. The loan is secured on the borrowers property through a process. Second time buyers can take out a mortgage of up to 80.

If youre applying for a mortgage jointly with someone else lenders will use your combined incomes to determine how much you can borrow which usually works out to much more than either applicant could afford on their own. See the average mortgage loan to income LTI ratio. Using the money from a second mortgage to improve your homes value can maintain the equity you.

The best reason to get a second mortgage is to use the money to increase the value of your home. Two ways to finance a vacation home. If your appraisal comes in below the purchase price of your home you may need to pay the difference in cash lower the purchase price or get a second.

Use our mortgage calculator to see how much mortgage you can get in the UK how much mortgage you can afford and how much deposit you need for a mortgage. There are two main ways to finance a second home or vacation property. Terms for private student loans can be as short as five years and as long as 20 years.

How long will I live in this home. After performing the calculation you can transfer the results to our mortgage comparison calculator where you. A change in mortgage rules that says lenders no longer have to check whether homeowners could afford repayments at higher interest rates could mean that some people are able to borrow much more to.

Fill in the entry fields and click on the View Report button to see a complete amortization schedule of the mortgage payments Bankrate. The piggyback second mortgage can also be financed through an 8020 loan structure. How much you can borrow for a mortgage in the UK is generally between 3 and 45 times your income.

Compare our range of financial services online. We offer a range of products including home loans business loans personal loans and car loans. How much can I borrow.

Please get in touch over the phone or visit us in branch. This mortgage finances the entire propertys cost which makes an appealing option.

Vintage House Plans 1960s Cottages And Second Homes Vacation House Plans Vintage House Plans Vintage House Plans 1960s

U Haul Home Renovation Loan Moving Truck New Home Buyer

Getting A Second Mortgage Td Canada Trust

Mortgage Santander Buying Your First Home How To Plan First Home

What Is Mortgage Insurance We Ve Got The Answers On Our Blog Mortgage Mortgage Tips Private Mortgage Insurance

Can I Get A Home Loan With No Deposit The Borrowers Home Loans Mortgage Companies

Another Monday Another Mortgage Glossary Term Let Us Tell You A Little Bit About Appreciation Appreciati Home Equity Line Of Credit Mortgage Interest Rates

Heloc Infographic Heloc Commerce Bank Mortgage Advice

The Ultimate Real Estate Loan Guide Infographic Health Mortgage Payment Calculator Cleveland Clinic

Getting A Second Mortgage Td Canada Trust

Interested In Borrowing Against Your Home S Available Equity To Pay For Other Expenses The Good News Is You Have Ch Home Equity Line Of Credit Mortgage Payoff

Getting A Second Mortgage Td Canada Trust

5vjvisnbhz4mtm

A Home Loan Or Mortgage Is When You Borrow Money From Another Person Or Institution To Pay For A Property Gettos In 2022 The Borrowers Borrow Money Home Loans

Why Is Home Equity Important Www Facebook Com Sklentzeris Mortgages101 Mortgage Homesale Homebuying Realtor Sandykle Home Equity Home Equity Loan Equity

12 Things Canadians Don T Know About Second Mortgages Canadian Mortgages Inc

Ever Gone To A Lender To See About Getting A Loan And Felt Like They Were Speaking Another Language Get A Loan Mortgage Interest Rates Home Financing